A Whole Brain Living approach to understanding yourself

Have you ever heard someone say, “If you don’t like the weather, wait five minutes”?

That’s what thoughts can feel like for most of us.

Our inner world shifts fast. Moods roll in like sudden cloud cover. A memory can change the emotional temperature of a moment. And sometimes you can feel completely different within a single hour without consciously choosing any of it.

It is not that you are inconsistent, too sensitive, or overreacting. It may simply be that different parts of your brain are taking turns leading.

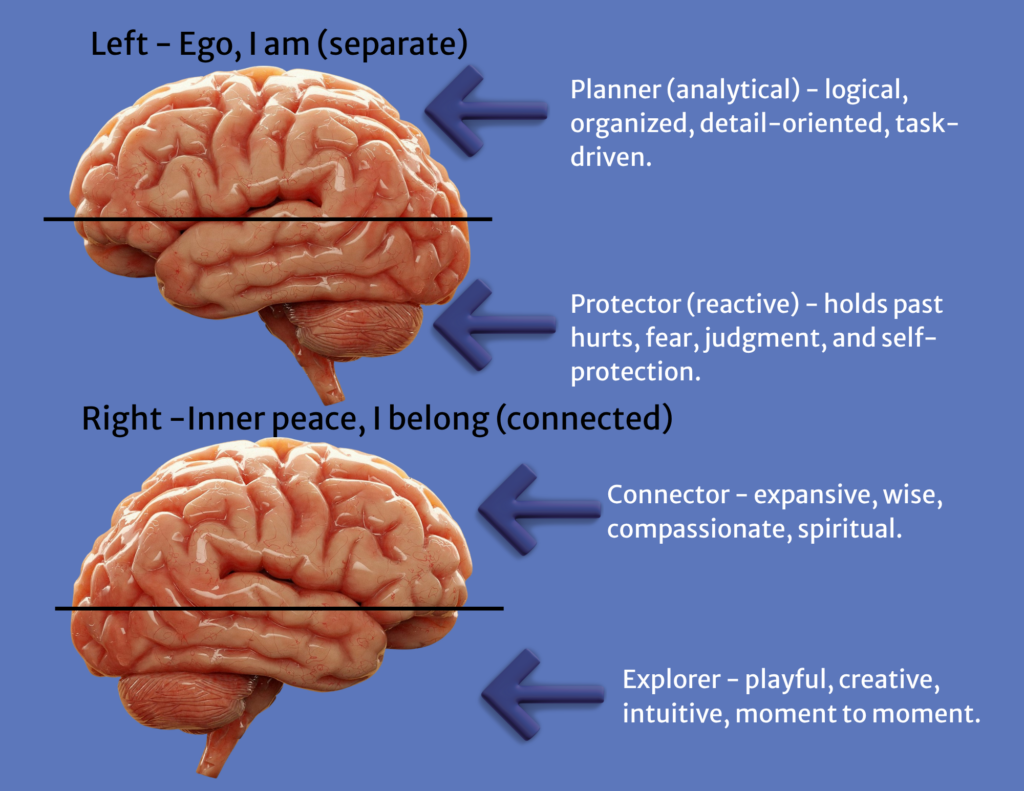

In Whole Brain Living, Dr. Jill Bolte Taylor describes what she calls the Four Characters. These are four distinct patterns of thinking and feeling that arise from the left and right sides of the brain. Each has its own personality, pace, strengths, and priorities.

When we are unaware of this internal dynamic, the shifts can feel confusing or even destabilizing. But when we begin to recognize which character is active, something powerful happens. We gain choice.

The weather inside does not stop changing.

But we stop being surprised by it.

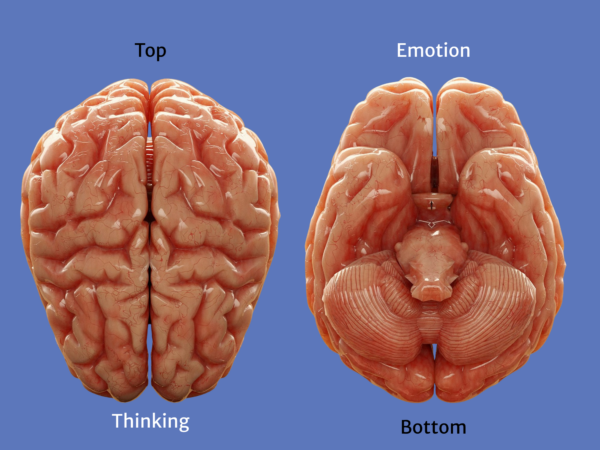

In the image above the brain is separated by thinking on the top and emotion on the bottom of the brain. Ten points for noticing that there are two separate halves as well (This image is for illustrative purposes only and is representation of the human brain).

Your Brain Is a Weather System, Not a Single State

Most of us grow up thinking we should be one consistent version of ourselves at all times.

But in Whole Brain Living by Dr. Taylor, you learn that you are actually a combination of:

- Left Thinking (Character 1): The planner, the organizer, the one who loves lists and order.

- Left Feeling (Character 2): The protector, the one who remembers hurt and tries to keep you safe.

- Right Feeling (Character 3): The playful, creative, spontaneous energy—your inner child.

- Right Thinking (Character 4): The calm observer, the expansive, connected, “it’s all going to be okay” presence.

Each part has a purpose. Each part shows up to help.

But when you don’t know who’s driving the bus, your internal weather can feel unpredictable and overwhelming.

Most of the Shifts Happen Before You’re Aware of Them

This is the part many people miss.

Whole brain living isn’t about controlling every thought or emotion—it’s about noticing which “character” just rolled in, just like noticing when the wind changes.

Sometimes:

- Character 2 storms in because something touched an old wound.

- Character 1 takes over because you’re overwhelmed and trying to feel in control.

- Character 3 appears when you’re relaxed and safe.

- Character 4 softens everything when you slow down long enough to let it speak.

These shifts happen in seconds, and often below conscious awareness.

But once you start recognizing them, you can choose your response rather than getting swept away by the storm.

Why This Matters for Your Everyday Life

When you understand your inner weather system:

- You stop blaming yourself for being “all over the place.”

- You recognize when fear, memory, joy, or logic is actually speaking.

- You learn how to soothe the storm instead of fighting it.

- You get better at knowing what you need—right now, in this moment.

This is self-awareness in real time.

Not perfection.

Not constant calm.

Just skillfully meeting yourself again and again.

A Simple Practice to Get Started

The next time you notice your inner weather shifting, pause. Think of the Four Characters like guests in a room.

Then gently ask yourself:

“Who just walked in?”

- Is it the planner?

- The protector?

- The playful one?

- Or the peaceful one?

You do not have to judge the answer. Just notice it.

Then take one slow breath, letting the exhale be slightly longer than the inhale.

That single breath gives your nervous system a moment to settle. It allows another part of your brain to participate before you react.

Naming creates awareness.

Breathing creates space.

Space creates choice.

The weather inside you will still change. That is part of being human.

But when you learn to recognize the shift, you begin to see patterns. You notice transitions. And over time, you learn how to carry an umbrella before the storm hits.